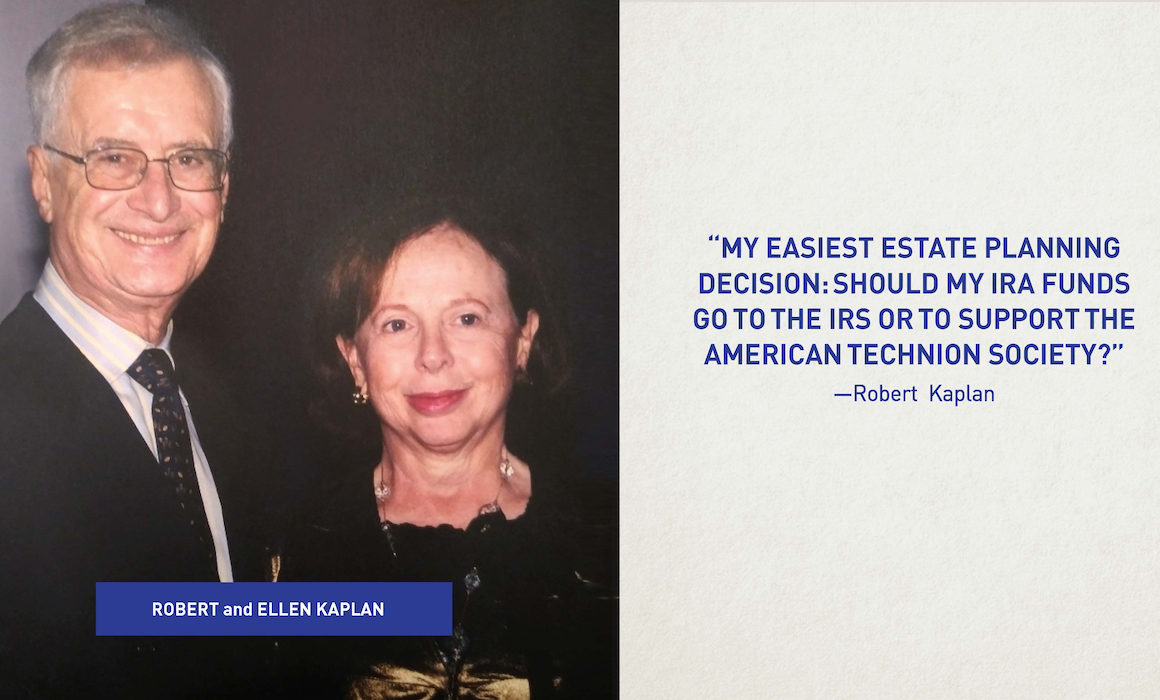

When considering how to best direct his IRA funds, ATS donor Robert Kaplan shared, “My easiest estate planning decision: Should my IRA funds go to the IRS or support the American Technion Society?” Making a charitable donation with your IRA withdrawal is a win-win strategy.

The IRS requires you to take mandatory annual distributions on your IRA at age 72, which are subject to ordinary income taxes and could put you in a higher tax bracket. However, a tax-relief strategy is available starting at age 70 ½. It allows you to direct IRA distributions of up to $100,000 per year to a qualified 501c3 charity, such as the ATS. You do not incur any income tax on this Qualified Charitable Distribution because the income goes directly to the ATS. Your IRA distribution can support students, faculty, or research at Technion.

In addition, IRAs left to heirs are subject to taxes that can slice away as much as 65% before your loved ones receive a penny. However, if you name the ATS as a beneficiary of all or part of your IRA, 100 cents on the dollar goes to the ATS tax free. Then you simply share a copy of the IRA beneficiary designation form with the ATS. This is truly a win-win option.

To learn more, contact Judy Sager, Executive Director of Planned Giving, at judy@ats.org or 781.531.0441.